What Are ESAs And How Do They Work?

“ESA” is an acronym used for more than 150 different organizations, technology, policies and other entities.

European Space Agency. Endangered Species Act. Emotional Support Animal. Entertainment Software Association. Eastern Surfing Association. Economic and Statistical Analysis. But in the education world, ESA stands for “educations savings account.”

In K–12 education, ESAs are state-based programs where parents are given funds to pay for approved educational expenses that allow them to customize an education that fits their child’s needs. They could use their funds for therapies, specialized tutors, curriculum, private school tuition and more. K–12 ESA programs are still fairly rare in the United States, but they are growing in popularity among parents and teachers.

The term, however, may still confuse folks as it can also be used to represent Coverdell ESAs, which parents use to invest in their child’s college education. To further complicate things, 529s are also college savings plans that are often accidentally conflated with K–12 ESAs. These three types of programs are distinctly different, though. Here’s how.

Coverdell Education Savings Accounts (Coverdell ESAs) and 529 Plans

Coverdell education savings accounts, or Coverdell ESAs, are a type of account that offers a tax-advantaged way for parents to save money for a specific purpose—namely, their children’s education.

Coverdell ESAs are a federal program similar to 529 college savings plans, though there are important differences between the two. They offer tax-free growth for your investment and tax-free withdrawals. Unlike 529 plans, parents can use their Coverdell ESA funds to pay for certain K–12 educational expenses as well as college expenses.

The key distinguishing factor with Coverdell ESAs: To get a Coverdell ESA or 529 plan, families must choose to open an account and contribute money out of their own pockets to accrue savings. In other words, any parent can open a Coverdell ESA or 529 plan, but they have to have the money.

Features of Education Savings Account (ESA) Programs in K–12

K–12 ESAs have been around for almost a decade. Arizona was the first state to create ESAs for families in 2011, but they are a relatively new innovation in the history of K–12 education. Since 2011, a handful of other states launched their own ESA programs.

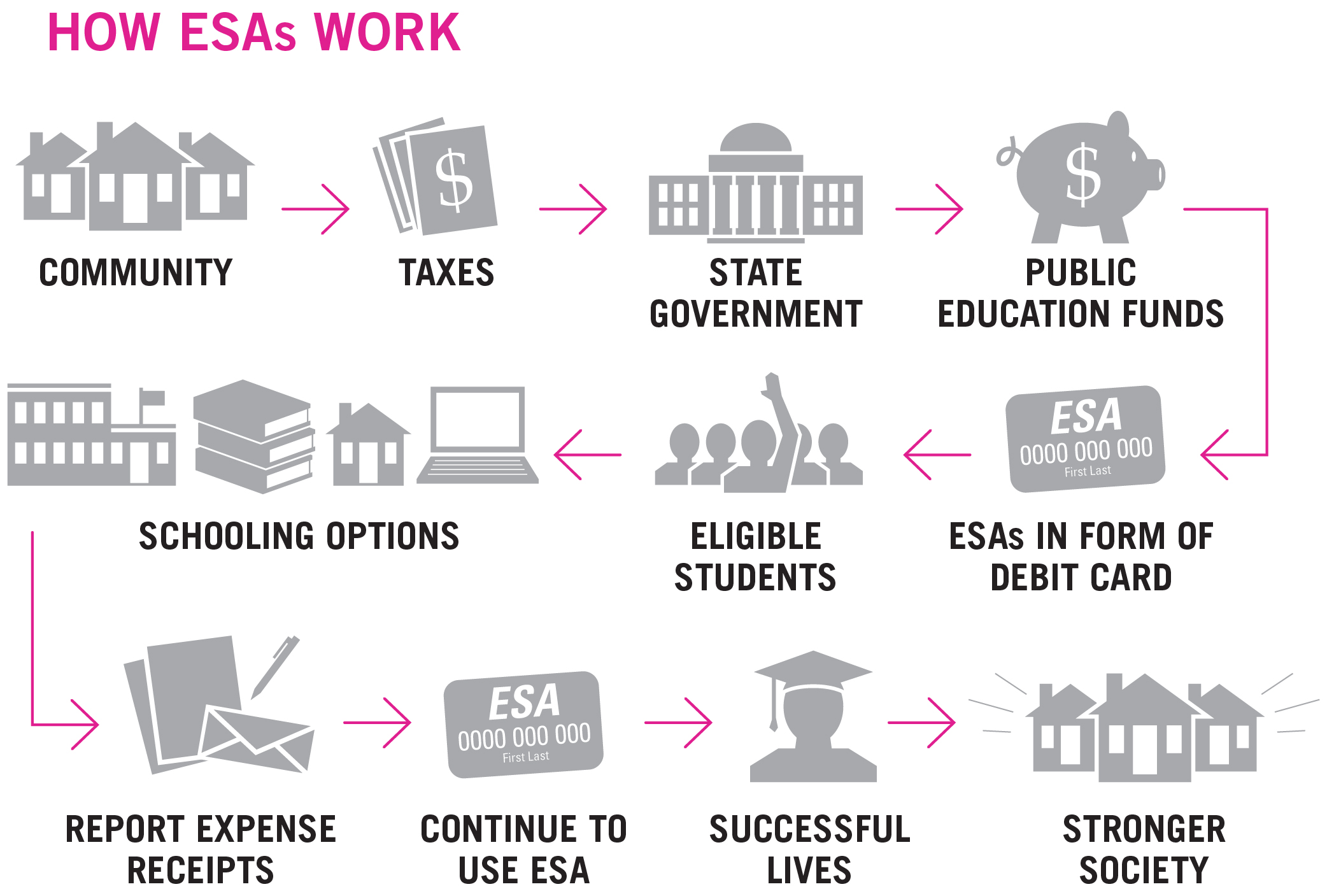

The key distinguishing factor with ESA programs in K–12 education: The money doesn’t come from parents’ pockets. Unlike Coverdell ESAs or 529 savings accounts, funding for these types of programs comes from the tax dollars the government already sets aside for every child’s education. Instead of that money going directly to a ZIP Code-assigned traditional public school your child might not even attend, the money follows your child to the school or other education providers you choose for them. This allows families with more modest incomes to access more and diverse schooling options for their children, a luxury only affluent families could enjoy before educational choice programs like ESAs began to take hold in the states.

Here are some other features of ESAs for K–12 students:

• Governments place restrictions on how funds can be used to protect against fraudulent spending. ESAs are restricted to education-related expenses only.

• Governments authorize eligible families to use of these funds, often in the form of a debit card, to pay for a variety of educational goods and services to customize a child’s education. Authorized uses may include:

– Private school tuition and fees

– Online learning programs

– Private tutoring

– Therapies

– Community college costs

– Higher education expenses

• Some ESA programs allow parents to save funds from quarter to quarter, or school year to school year, to use for future educational expenses, such as college tuition or more expensive learning therapies.

• Cases of misusing funds tend to be low and rare. Parents usually must report ESA expenses periodically, and states may conduct random audits.

How do ESAs differ from other private school choice programs?

School vouchers and tax-credit scholarships (TCS) are two other types of private school choice programs. ESAs differ in important ways. For starters, vouchers and tax-credit scholarships typically may be used only to cover private school tuition and fees, whereas ESAs are not limited to tuition. Some experts argue that this arrangement is better at promoting efficiency.

Another argument that favors ESA policy over vouchers and tax-credit scholarships relates to potential benefits for families who live in rural areas with limited schooling options. ESAs can be an effective tool for expanding access to educational options beyond the traditional setting of a school building. For instance, it would allow families to access different classes or curricula that may not be offered in their local schools.

Does My State Have a K–12 ESA?

Five states have ESA programs to date, though many more states are considering creating them. The list below includes the names of existing programs along with quick links to those program details, which include eligibility quizzes, approved expense types, funding amounts and more.

AZ – Arizona – Empowerment Scholarship Accounts

FL – Florida – Gardiner Scholarship Program

MS – Mississippi – Equal Opportunity for Students with Special Needs Program

NC – North Carolina – Personal Education Savings Accounts

TN – Tennessee – Individualized Education Account Program

If you don’t see your state in this list but you’d like more information about the possibility of ESAs in your state, please contact us at info@edchoice.org.