What the EdChoice Public Opinion Tracker Tells Us About Teacher Pensions

How will the COVID-19 recession change the landscape of K-12 education for students, families and teachers in the U.S.? Some predict a sharp increase in alternatives to traditional schooling such as homeschooling, hybrid homeschooling and microschools. Many private schools have already closed permanently because of the recession. And many districts have already announced plans to going partially or fully online.

What does all this mean for teachers? In some places, they may lose their jobs. In other areas, we may see increased demand for teachers to fill educational roles (perhaps to teach various online curricula or to meet increased demand to fill tutoring services). New settings for delivering education that are popping up during the pandemic, such as “learning pods,” may offer new opportunities for teachers.

Indeed, the recession is making K-12 education quite messy for teachers. To deal with today’s crisis, it’s important to have systems in place that facilitate teacher mobility to meet changing demands across K-12 education. Unfortunately for many teachers, there’s perhaps no better (or worse) example of an area in K-12 ill-designed to meeting challenges from the recession than teacher pensions.

According to data from the Bureau of Labor Statistics, 90 percent of public school teachers are enrolled in defined benefit plans. The most common type, final salary defined benefit plans, determine a worker’s retirement benefit by how long they work and their salary. These plans are typically backloaded and accrue benefits in an unsmooth manner (benefits accrue slowly in the beginning and middle of a teacher’s career and ramp up rapidly as a teacher approaches key points in their career for retirement eligibility).

These plans by design also reward teachers who stay in one system for a full career—at the expense of more mobile teachers. It’s reasonable to expect, then, that these places would have some influence over teachers’ decisions to move or change jobs.

The EdChoice Public Opinion Tracker, which launched earlier this year, includes a monthly survey of the general public on popular K-12 issues and a quarterly survey of current K-12 educators across various schooling types.

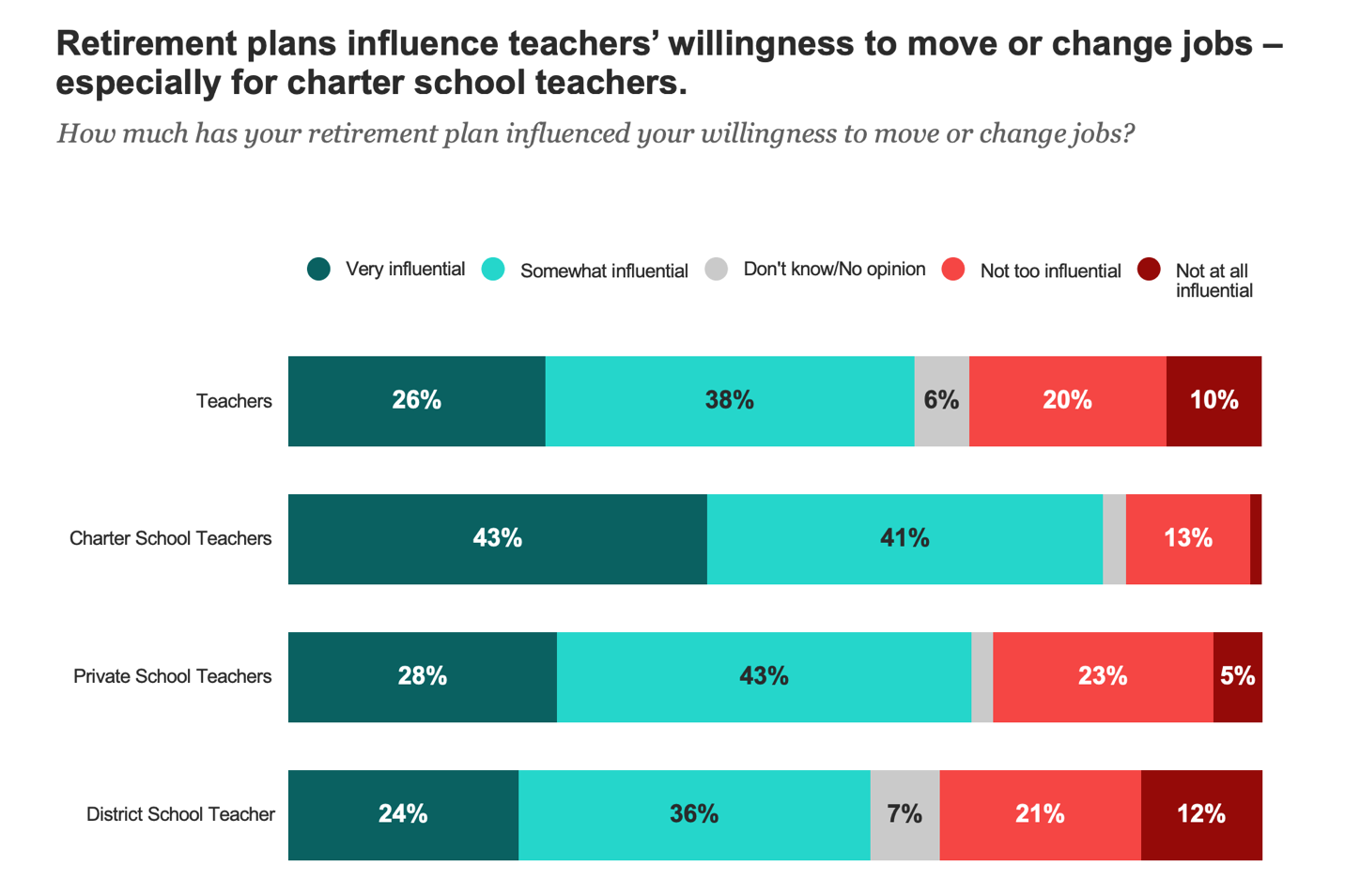

In the latest wave of data from June, more than half of teachers indicated retirement plans were very or somewhat influential in their decisions to move or change jobs. Retirement plans seem to be more important for charter and private school teachers than teachers in district schools.

We asked teachers how retirement plans affected their decisions to consider teaching in other schools, and 39 percent indicated that they decided not to pursue any teaching opportunity at another school because a pension plan lacked portability. This result suggests the importance of portability in retirement plans as a contributing factor to teachers’ willingness to move or change jobs. Offering pension plans with better portability could help schools facing staffing shortages attract teachers.

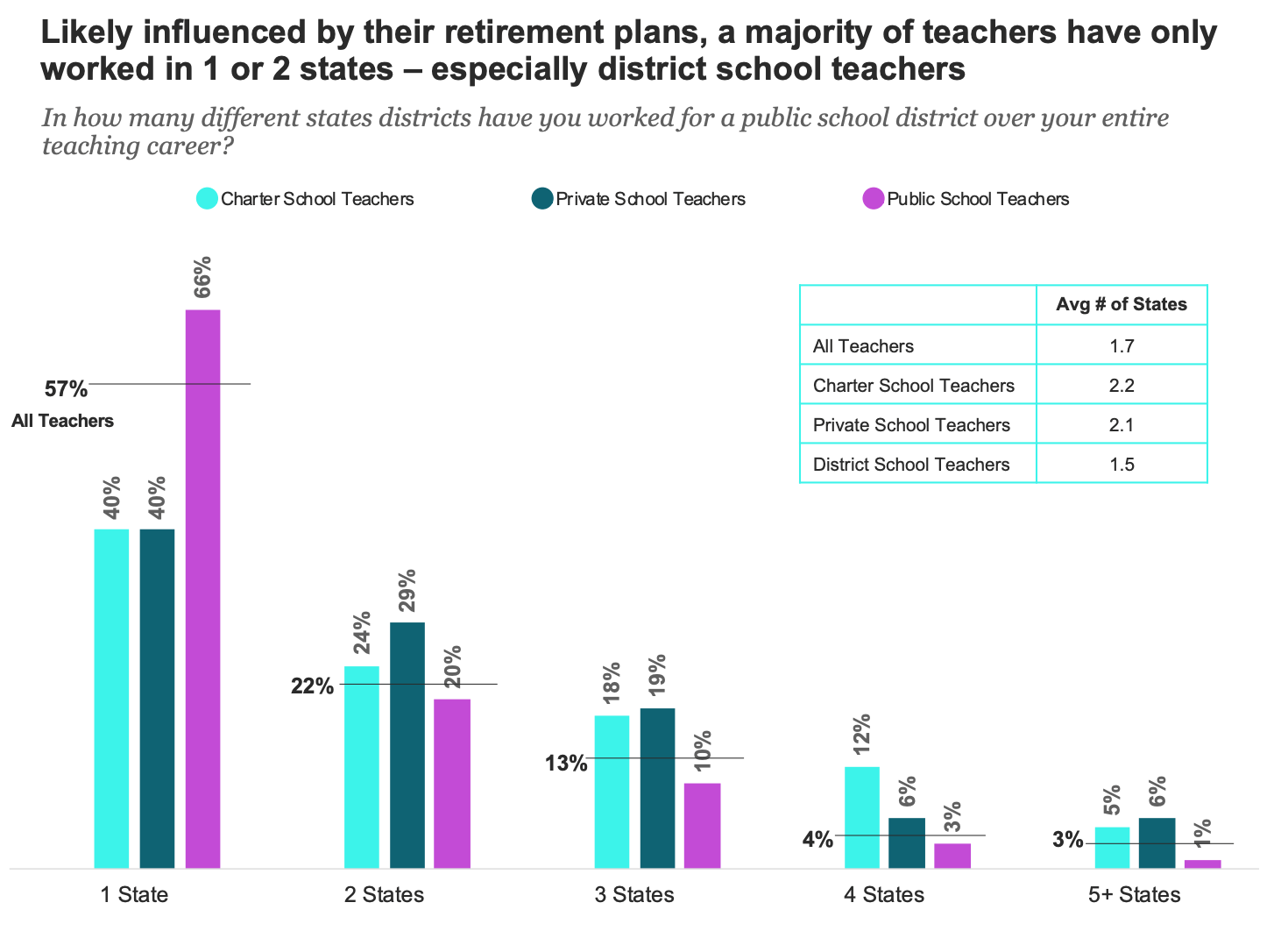

We also asked teachers about how many states they’ve taught in during their teaching career. More than half (57%) taught in only one state. The reminder (43%) have taught in two or more states. District school teachers are more likely to have taught only in one state, although one-third of them have taught in multiple states (and hence have split time between retirement systems). It’s important to note that if these teachers do not remain in a system long enough to reach retirement eligibility to collect full or early retirement benefits, then they will likely incur significant mobility costs to their pension accrual.

These results suggest that many teachers are mobile, and retirement plans factor, in some way, into their decisions to move or change jobs. Do our K-12 systems provide teachers with retirement plans that put all teachers on a path to retirement security? There are reasons to expect otherwise.

The structure of most teacher pension plans heavily favors teachers who remain in a system for a full career and disfavors teachers who do not (young teachers, mobile teachers who switch schools across systems or cross sectors, teachers who switch careers). Robert Costrell and Josh McGee show that in the case of California, two-thirds of all entering teacher are “pension losers,” meaning they receive benefits worth less than the uniform contribution rate for teachers. In effect, these two-thirds teachers are subsidizing benefits for teachers who remain in the system longer.

The lack of portability (and other features) in most final-salary defined benefit plans is often seen as a roadblock to a mobile teaching workforce. Some also point to the design of these plans as obstacles to attracting good teachers. The decision by a teacher to leave a system before reaching retirement eligibility can be a very costly one.

Economists Robert Costrell and Michael Podgursky show that a teacher who splits a career working in two different retirement systems in some cases loses more than half of net pension wealth compared to a teacher who works the same number of years under one system. These losses can be substantial, worth hundreds of thousands of dollars.

In addition, it can take decades for teachers to accrue enough pension benefits to equal the value of their cumulative contributions. Chad Aldeman and Andrew Rotherham showed that most public school teachers who leave a system (for any reason) do so before they become eligible for full pension benefits—just 20 percent for the median state-sponsored teacher-covered pension plan.

To be clear, portability (or lack of) is a matter of plan design, not a feature of any specific type of plan. Most public school K-12 teachers are covered by final-salary defined benefit plans that are structured in ways that significantly lack portability. While it is true that some states do offer plans with good portability features built in—South Dakota and Wisconsin are examples—these cases represent a very small minority.

Results from our tracker poll highlight some of the big issues facing retirement plans offered to teachers. Teachers who are not sure if they want to teach within a single retirement system for an entire career should take care to become familiar with their future retirement benefits and the system they’ll be enrolled in.

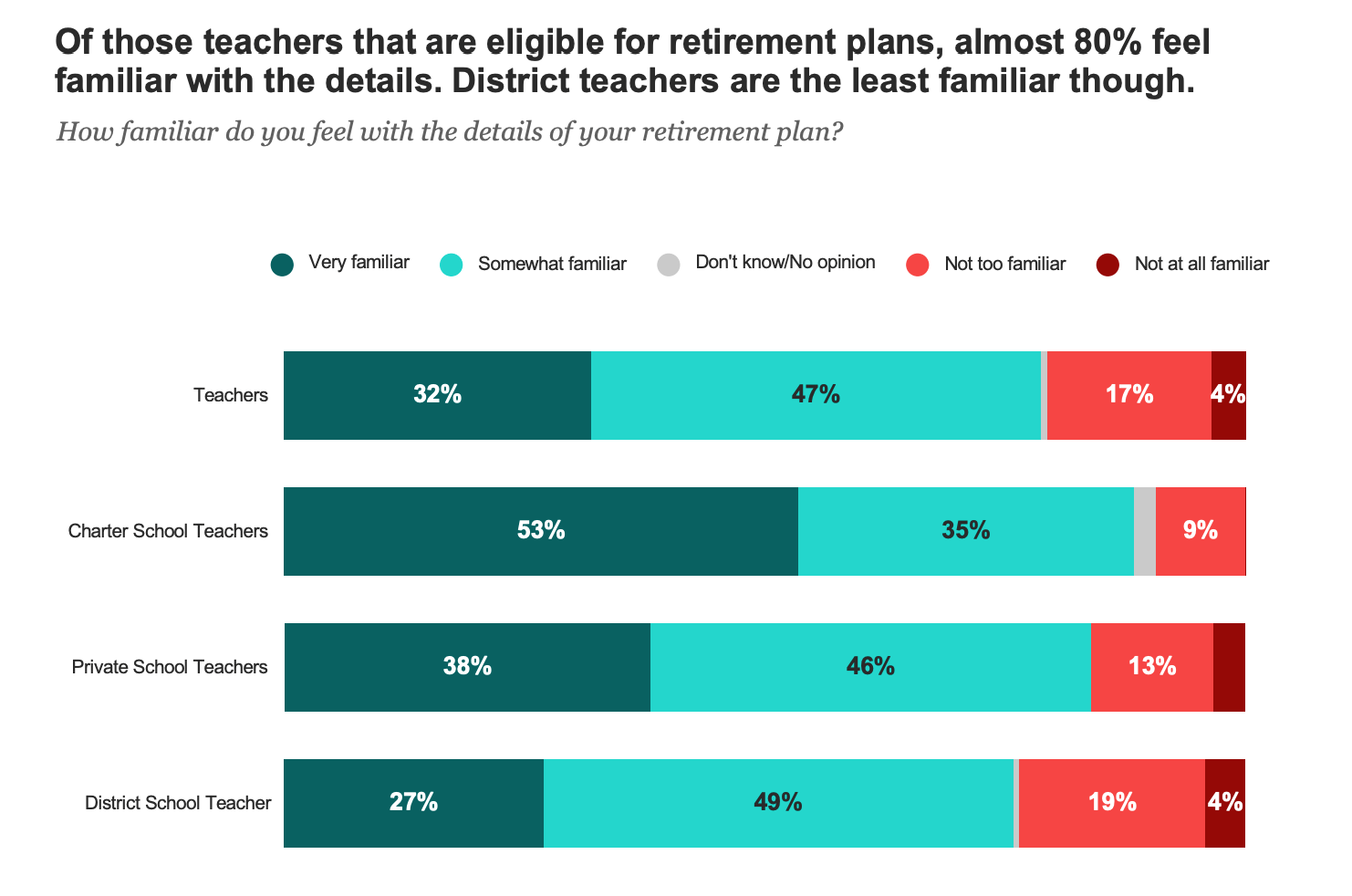

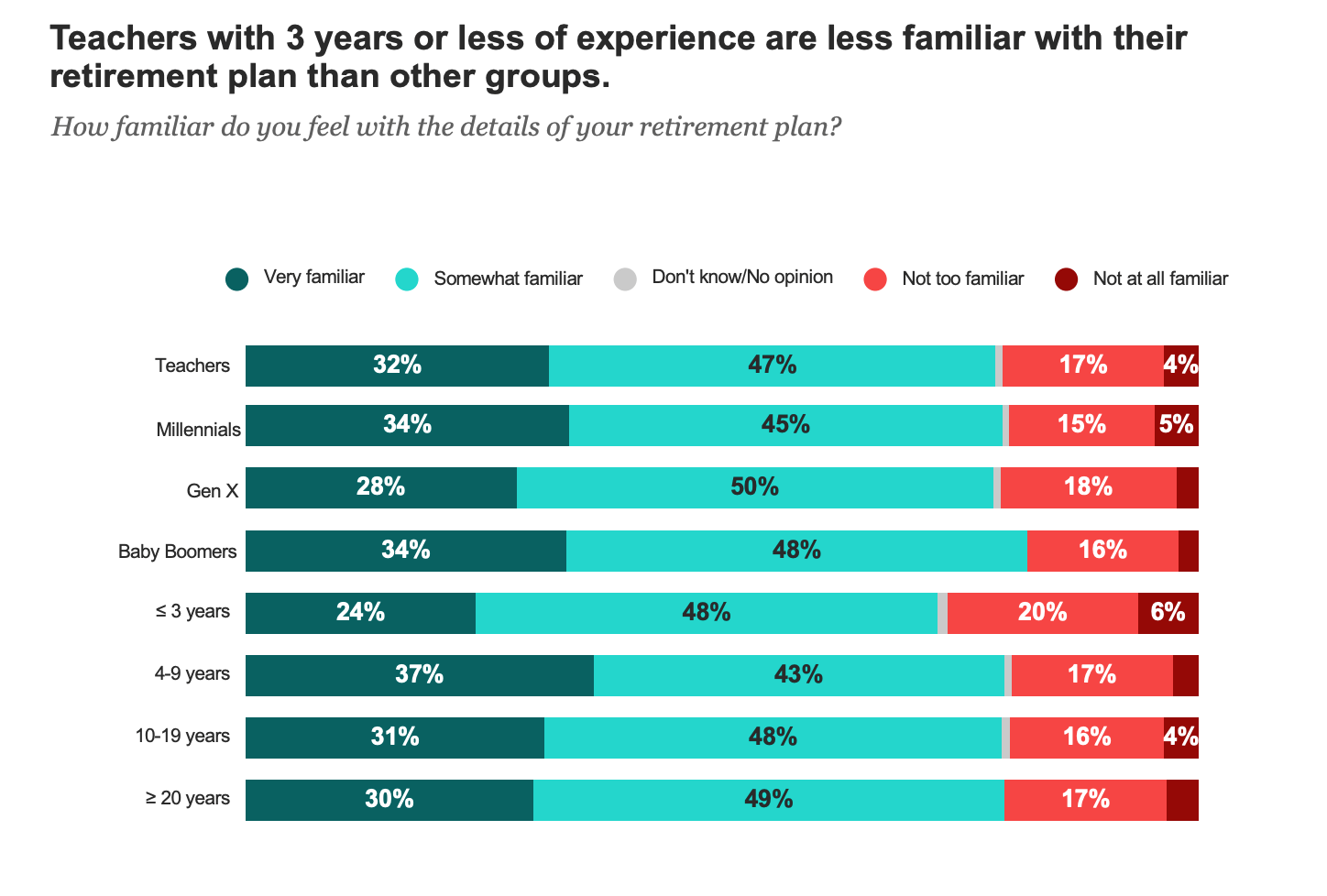

Surprisingly, about one-fifth of teachers indicate they are not familiar with their pension plans. District school teachers are less likely to be very or somewhat familiar with their pension plans than teachers in public charter schools and private schools. Newer teachers with fewer years of experience also are less likely to be familiar with their retirement plans. Are there ways to improve how teachers are informed about their retirement plans?

In today’s environment, countless students nationwide face uncertainty about their learning environments in the upcoming school year. What’s certain is that teachers will play an increasingly critical role in learning for many of those students. It only makes sense to have greater flexibility and fairness built into our educational systems to help teachers meet the changing needs and demands of families in today’s environment.