Arkansas introduces a universal tax credit-funded ESA bill, takes a huge step for students

UPDATE March 31, 2017

Arkansas’s SB 746, a tax credit-funded education savings account (ESA) similar to the failed HB 1222, also failed to pass in the House in a 50–39 vote.

UPDATE March 21, 2017

Although Arkansas’s HB 1222, outlined below our previous update, failed to pass on the House floor, an amended Senate version (SB 746) has similar wording to HB 1222, would create a Parental Choice Pilot Program and is making its way through the legislature. Learn what makes this bill different in the bulleted list below:

- The program, an ESA, would be limited to three years (2018–19 through 2020–21).

- Contributions to college savings accounts are excluded.

- Up to $3 million in tax credits would be available in any year and the potential 10 percent annual increase was removed.

- A maximum of 1 percent of eligible students who were enrolled in a particular public school district as of October 1 of the previous school year may be approved for an ESA.

- For every approved ESA student previously enrolled in private school there must be at least two students previously enrolled in a public school approved for an ESA. The latter group includes incoming kindergarteners, students new to the state and students new to a public school district.

- Students enrolled in a private virtual school would receive one-third of the state’s foundation funding amount ($2,215 for 2016–17) plus one-sixth ($1,108 for 2016–17) for each public school course. The aggregate amount cannot exceed the foundation funding amount ($6,646 for 2016–17).

- Aggregate rollover funds cannot exceed the amount of funds received in the previous school year.

UPDATE March 16, 2017

The Arkansas House voted down HB 1222, the bill outlined below that would’ve created the nation’s first tax credit-funded ESAs.

UPDATE March 2, 2017

This summary has been changed to reflect adopted amendments to the bill.

Yesterday, 20 State Representatives and three State Senators introduced The Arkansas Parental Empowerment for Education Choice Act of 2017 in the House. The bill, if passed, would set up a tax credit-funded education savings account (ESA) program for which all K–12 students in The Natural State would be eligible.

That’s right – a completely universal educational choice program!

The potential program would operate in a similar fashion to ESAs in other states, but it would be funded in a way more akin to tax-credit scholarships.

Here’s how it would potentially work, as laid out in the bill:

- Nonprofit organizations apply to the state in order to be eligible to grant ESAs to students—and up to five organizations may be certified

- Taxpayers (both businesses and individuals) donate to those nonprofits and receive up to a 100 65 percent credit on their state income tax (up to $6.5M $10M in credits would be available in 2018–19 2017—and this amount can increase 10 percent each year)—any unused credits may be carried forward for five years

- Parents apply to the ESA-granting nonprofits for their K–12 students, who must be residents of the state and eligible to enroll in a public school

- The ESA-granting organizations approve applications, in the following order:

- Students who received an ESA in the previous school year

- Siblings of students who received an ESA in the previous school year

- Students retained on the previous school year’s wait list who qualify for the federal free and reduced-price lunch (FRL) program ($44,955 for a family of four in 2016–17)

- New applicants who qualify for the FRL program Students from families who qualify for the federal free and reduced-price lunch (FRL) program ($44,955 for a family of four in 2016–17)—only if the proportion of FRL applicants is less than the proportion of FRL students statewide

- Students who are dependents of active-duty military members stationed in Arkansas

- All other students retained on the previous school year’s wait list

- By lottery, all other eligible students

- ESA-granting organizations transfer the state’s foundation funding amount ($6,646 for 2016–17) into an account for the student

- Parents can then use the funds to pay for private school tuition and fees; online learning programs; textbooks; tutoring services; curriculum or other instructional materials; fees for testing, including nationally norm-referenced tests, AP exams, college placement exams, and industry certification exams; fees for academic-instruction focused after-school or summer programs; contracted services provided by a public school district; contributions to a college savings account; community college tuition and fees and textbooks; college tuition and fees and textbooks; services for special needs students and transportation.

- Up to half of any unused funds received in a school year may Funds still left in an account at the end of the school year will be rolled over to the next school year, which can continue until a student reaches 22 years of age.

Students would not be able to receive an ESA while enrolled in public school and would not be able to receive both an ESA and a voucher under Arkansas’s Succeed Scholarship Program for Students with Disabilities.

ESA-granting organizations would submit quarterly reports and undergo an annual audit, but there are very few restrictions on participating schools and other providers. Schools are only required to certify on a semiannual basis under oath that ESA students have been enrolled and attending on an annual basis, and other providers must be able to certify that the ESA student(s) have been receiving educational services from them.

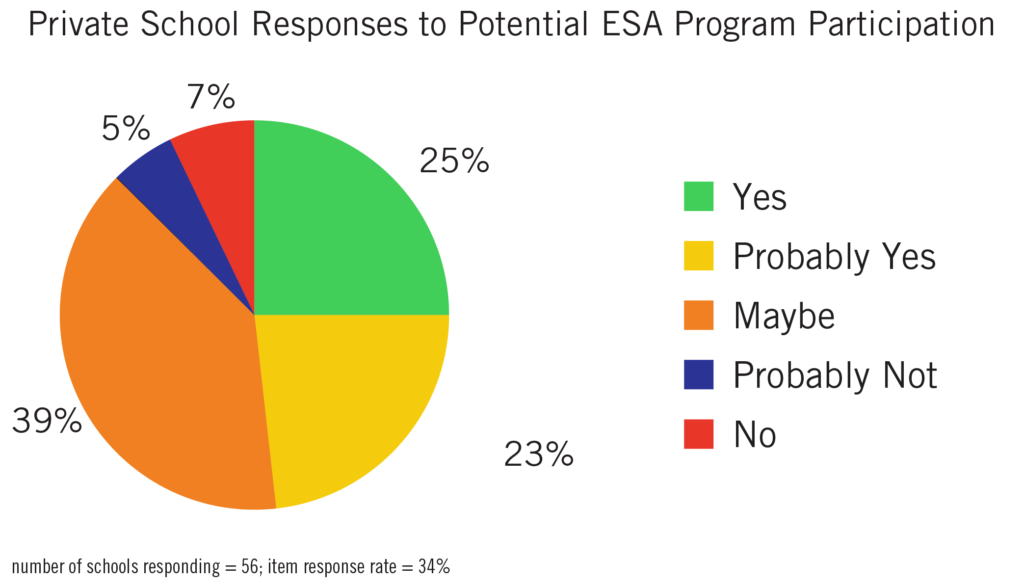

That is great news for Arkansas private schools interested in participating in the program—nearly half of the Arkansas private schools that participated in my survey last year (48 percent) said they would or probably would participate in an ESA program if it was enacted, even though only one-quarter of the responding schools (25 percent) were previously familiar with the concept of ESAs for K–12 education.

In that same survey report, Exploring Arkansas’s Private Education Sector, I projected that there were nearly 9,500 open seats for K–12 students in Arkansas’s private schools in 2015–16. The double-edge of that sword is that there wouldn’t be enough space in Arkansas’s private schools to accommodate the more than half million students not already attending them, meaning a mass exodus from the public school districts isn’t really possible. It’s also highly improbable based on participation rate data for other programs—typically somewhere around 1 percent of eligible students participate in a program’s first year and closer to 2 percent participate in the second year.

We here at EdChoice think that the bill introduced yesterday is a giant leap in the right direction, and we applaud and thank all of the legislators who are paving the way for Arkansas to become a leader in educational choice.