Can I Use a 529 Plan for K–12 Expenses?

If you’ve done much research into how to save for your child’s college education, you’ve probably heard of 529 plans. These plans, created as part of the Small Business Job Protection Act in 1996, were originally meant to give parents a tax-advantaged way to save for college expenses. Parents could get federal income tax benefits as long as they used the money for certain qualified educational expenses—all at the postsecondary level.

But the Tax Cuts and Jobs Act, passed in 2017, expanded the allowable uses of these accounts to include up to $10,000 in annual private K–12 tuition expenses, as well. This could be helpful for some parents who want to send their children to private elementary or secondary schools. However, tax laws like this one are extremely complex, so be sure you understand all the implications of using a 529 plan for K–12 expenses before you go this route.

529 Plan Basics

Anyone can open a 529 plan with anyone else as a beneficiary. Adults can even use them to save for continuing educational expenses. But the most common use is for parents or other relatives to open a 529 account with a child as the beneficiary. This means the money is to be used for the child’s education, but the parent or other account custodian actually controls the funds.

As long as the money is used for the beneficiary’s allowable educational expenses—including up to $10,000 per year in private K–12 tuition expenses or college-related tuition, fees and other expenses—it grows federal income tax-free. Contributions and growth may also carry state tax benefits, which we’ll discuss below.

The key, though, is that the money must be used for the beneficiary’s benefit, and it must be used for qualified educational expenses. If you use the money for a non-qualified expense, then you’ll have to pay taxes plus a 10 percent penalty on any earnings—not original contributions—you withdraw.

That’s why it’s important to follow the rules when using 529 funds. When used properly, the tax benefits on your 529 can be a powerful way to help save for your child’s education. When you don’t pay income taxes on growth, your account compounds more quickly and gives you more money to work with when it’s time to pay for private K–12 education or college. Not sure exactly what it looks like? Here’s an example:

Why 529s are Powerful: An Example

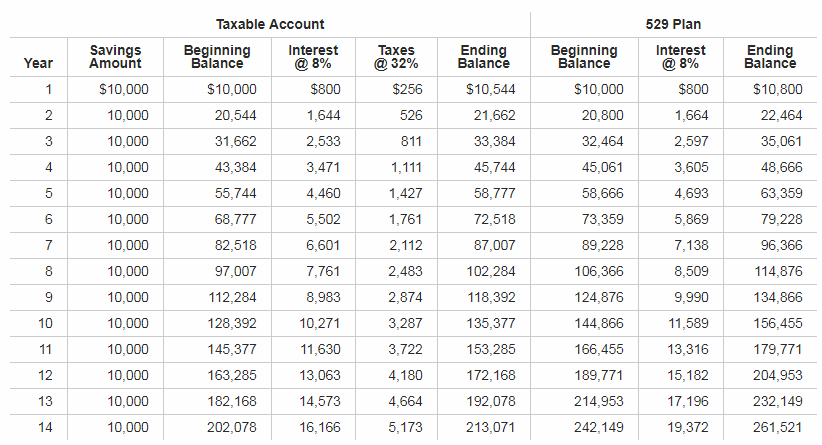

Let’s say you pay a 32 percent marginal tax rate. You start with $0 invested in a 529 when your child is born. Then you invest $10,000 per year for 14 years, until she’s ready to start attending a private high school. With an 8 percent average return on investment, and not accounting for any potential state tax payments or benefits, you’d end up with the following results, according to this calculator:

By age 14, your child would have $261,521 available in a 529. If you’d saved the money in a taxable account instead, you’d only have $213,071. That’s a difference of nearly $50,000!

For parents who already are planning and able to save for their child’s future private school education, this makes 529s a powerful tool. But before you rush to open one, make sure you understand all the ins and outs of how the 529 and its recent changes work.

Federal Tax Benefits

Remember that the 529 plan is primarily driven by the federal government. So regardless of your state’s rules and regulations, you can get the federal tax benefit when you use this account for qualifying K–12 expenses. You don’t get a federal income tax benefit for contributing to a 529, since you contribute money after you’ve already paid federal income taxes. But you avoid paying federal income taxes on the growth, as long as you use the money for qualified expenses.

Exactly how much the federal benefits will affect your family’s bottom line will vary. Certain interest income and dividends are taxed at your ordinary marginal tax rate. Capital gains from stocks and mutual funds are taxed at a lower rate, and may not be taxed at all for lower-income families. This means families in lower tax brackets will receive less in total federal income tax benefits than families in higher tax brackets.

Let’s look at another simplified example. (Note that it doesn’t account for interest income pushing the family into the next tax bracket.)

Family A is in the 24 percent marginal tax bracket, but Family B is in the 35 percent marginal tax bracket. Both families earned $2,000 on their 529 accounts this year. Family A would save $480 due to the 529 rules, and Family B would save $700.

Either way, income tax-free growth in a 529 account is of benefit. It just benefits higher-earning families a bit more than lower-earning families.

State Tax Benefits and Caveats

Here’s where things get complicated. To begin with, not all states offer the same tax benefits for their state-run 529 accounts. And you can open a 529 in any state you’d like.

The benefit of opening a 529 with your own state of residency, though, is that you could qualify for state tax benefits. Until the recent K–12 changes, most states mirrored federal 529 regulations. For instance, in most states, you don’t pay state income tax on interest growth in a 529 account, even if you open an out-of-state 529 account.

What’s more, many states offer their residents additional state tax benefits for contributing to a 529. Some offer tax credits and others offer tax deductions. Most states only apply these additional benefits to in-state 529s, but some allow for credits or deductions based on contributions to out-of-state 529s, too.

However, the new K–12 eligibility rules have thrown some states for a loop. Many states are still debating how to incorporate this new rule into their 529 plans and tax benefits.

Although these changes applied to the 2018 tax year, which is now over, experts are still approaching this issue with caution. Brown said that even if states don’t adopt the federal amendments that allow for these expenses, taxpayers will still qualify for the federal tax benefits on their accounts. However, he said that if a taxpayer uses 529 distributions to pay for K–12 expenses before their state has adopted these changes, the distribution may not be considered qualifying for state income taxes.

“If this is the case,” he wrote, “the state could require the taxpayer to add the disbursement back into state taxable income.”

It also remains to be seen what will happen to taxpayers with out-of-state plans. The majority of states with income tax allow state income tax exemptions for 529 distributions even from out-of-state plans. So what happens if the state that holds your plan allows for K–12 expenses but the state you pay taxes in doesn’t? The state where you actually pay taxes will determine the consequences.

The bottom line is that all taxpayers are eligible for the federal income tax benefits on 529 disbursements for qualified K–12 expenses. But in states with income tax, it’s best to be absolutely sure how your state will handle the disbursement and resulting tax consequences before using your 529 for these expenses.

Where the States Stand

So how can you figure out what state income tax benefits are currently available for 529s and how those benefits may or may not change with the new K–12 rules? Here’s a handy table of each state’s 529 plan and potential tax benefits.*

| State | Plan Name and Link | How State Treats Qualified Distributions | Additional Tax Benefits | Total Balance Limit Per Beneficiary |

|---|---|---|---|---|

| Alabama | CollegeCounts 529 | Qualified distributions from an Alabama plan are exempt. Distributions from out-of-state plans are not exempt. | Alabama taxpayers can get a state tax deduction of up to $5,000 for single filers/$10,000 for married filing jointly for total combined contributions made to Alabama 529s in one year. | $475,000 |

| Alaska | University of Alaska College Savings Plan | No personal income tax. | No tax benefits because Alaska has no personal income tax. | $475,000 |

| Arizona | AZ 529 College Savings Plan | Qualified distributions from any 529 plans are exempt. | Arizona taxpayers can get a deduction of up to $2,000 for single filers/$4,000 for married filing jointly for combined annual contributions to any state’s 529 plan. | $453,000 |

| Arkansas | AR 529 GIFT Plan | Qualified distributions from any 529 plans are exempt. | Arkansas taxpayers can deduct up to $5,000 for single filers/$10,000 for married filing jointly for combined contributions make to AR 529 GIFT Plans. Unused excess contributions can be deducted over the next four succeeding tax years. | $366,000 |

| California | ScholarShare 529 | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $529,000 |

| Colorado | CollegeInvest Direct Portfolio | Qualified distributions from any 529 plans are exempt. | Colorado taxpayers can deduct any amount they contribute to the state’s 529 plan on their state taxes. | $400,000 |

| Connecticut | CHET 529 College Savings Program | Qualified distributions from both Connecticut and non-Connecticut plans are exempt. Also, nonqualified distributions from a Connecticut plan to the beneficiary are also exempt from state taxes, even though they are not exempt from federal taxes. | Connecticut taxpayers can deduct up to $5,000 for single filers/$10,000 for married filers per year. Unused excess contributions can be deducted over the next find taxable years. | $300,000 |

| Delaware | Delaware College Investment Plan | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $350,000 |

| District of Columbia | DC 529 College Savings Program | Qualified distributions from any 529 plans are exempt. | D.C. taxpayers can deduct up to $4,000 for single filers/$8,000 for married filers when they contribute to a DC College Savings Plan account. Excess contributions can be carried forward for future years. | $500,000 |

| Florida | Florida 529 Savings Plan | No personal income tax. | No personal income tax. | $418,000 |

| Georgia | Path2College 529 Plan | Qualified distributions from Georgia and non-Georgia plans are exempt as long as they comply with federal 529 rules. | Georgia taxpayers can deduct up to $2,000 per year per beneficiary for single filers or $4,000 per beneficiary per year for married filers filing jointly. | $235,000 |

| Hawaii | Hawaii’s College Savings Program | Qualified distributions from any 529 plans are exempt. | No additional state income tax benefits. | $305,000 |

| Idaho | IDeal Idaho College Savings Program | Qualified distributions from any 529 plans are exempt. | Idaho taxpayers can get a tax deduction of up to $12,000 for married filers/$6,000 for individuals for total Ideal contributions in a year. | $500,000 |

| Illinois | Bright Start College Savings Program | Qualified distributions from Illinois plans are exempt. Qualified distributions from out-of-state plans are only exempt if the plan meets certain disclosure requirements. | Illinois taxpayers can deduct up to $10,000 for single filers/$20,000 for married filing jointly of contributions for Bright Start accounts. | $400,000 |

| Indiana | CollegeChoice 529 Direct Savings Plan | Qualified distributions from any 529 plans are exempt. | Indiana taxpayers can get an income tax credit equal to 20 percent of their contributions, up to $1,000 per year. | $450,000 |

| Iowa | College Savings Iowa 529 | Qualified distributions from any 529 plans are exempt. | Iowa taxpayers can deduct up to $3,387 in contributions per taxpayer per beneficiary. | $420,000 |

| Kansas | Learning Quest 529 Educational Savings Program | Qualified distributions from any 529 plans are exempt. | Kansas taxpayers can deduct up to $3,000 for individuals/$6,000 for married filing jointly in contributions per child. | $402,000 |

| Kentucky | Kentucky Education Savings Plan Trust | Qualified distributions from any 529 plans are exempt. | No additional benefits. | $350,000 |

| Louisiana | START Saving Program | Qualified distributions from any 529 plans are exempt. | Louisiana taxpayers can deduct up to $2,500 for single account owners/$5,000 for joint account owners filing joint taxes per beneficiary per year. | $500,000 |

| Maine | NextGen College Investing Plan | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $500,000 |

| Maryland | College Savings Plans of Maryland | Qualified distributions from any 529 plans are exempt. | Maryland taxpayers can deduct up to $2,500 in contributions per beneficiary per year. | $350,000 |

| Massachusetts | Massachusetts U.Fund College Investing Plan | Qualified distributions from any 529 plans are exempt. | Massachusetts taxpayers can deduct up to $1,000 for single filers/$2,000 for married filing jointly. | $375,000 |

| Michigan | Michigan Education Savings Program | Qualified distributions from any 529 plans are exempt. Distributions due to beneficiary’s death, disability, scholarship or attendance at U.S. military academy are also exempt. | Michigan taxpayers can deduct up to $5,000 for single filers/$10,000 for married filing jointly in contributions. | $500,000 |

| Minnesota | Minnesota College Savings Plan | Qualified distributions from any 529 plans are exempt. | Minnesota tax payers may take either a deduction or credit for their contributions. The non-refundable credit option is equal to 50% of the contributions to 529 accounts for the year, up to $500. The deduction option is for up to $1,500 for single filers/$3,000 for joint filers. | $425,000 |

| Mississippi | College Savings Mississippi | Qualified distributions from any 529 plans are exempt. | Mississippi taxpayers can deduct up to $10,000 for single filers/$20,000 for joint filers per year. | $235,000 |

| Missouri | MOST 529 Savings Plan | Qualified distributions from any 529 plans are exempt. | Missouri taxpayers can deduct up to $8,000 for single filers/$16,000 for married filers for contributions. | $325,000 |

| Montana | Achieve Montana | Qualified distributions from any 529 plans are exempt. | Montana taxpayers can deduct up to $3,000 for single filers/$6,000 for married filing jointly of contributions made to accounts owned by the taxpayer, taxpayer’s spouse or taxpayer’s child or stepchild. | $396,000 |

| Nebraska | Nebraska Education Savings Trust – Direct College Savings Plan | Qualified distributions from any 529 plans are exempt. | Nebraska taxpayers who are account owners can deduct up to $10,000/$5,000 if married separately. | $400,000 |

| Nevada | Nevada College Savings Plan | No personal income tax. | No additional tax benefits. | $370,000 |

| New Hampshire | UNIQUE College Investing Plan | No personal income tax. Qualified distributions from any plan are exempt from New Hampshire interest and dividends tax. | No additional tax benefits. | $500,000 |

| New Jersey | NJ BEST Savings Plan | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $305,000 |

| New Mexico | The Education Plan | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $500,000 |

| New York | New York’s Direct Plan | Qualified distributions from any 529 plans are exempt. | New York taxpayers can deduct up to $5,000 for individuals/$10,000 for joint filers for contributions. | $520,000 |

| North Carolina | College Foundation of North Carolina | Qualified distributions from any 529 plans are exempt. | No additional tax benefits. | $450,000 |

| North Dakota | College SAVE | Qualified distributions from any 529 plans are exempt. | North Dakota taxpayers can deduct up to $5,000 for individuals/$10,000 for joint filers for contributions. | $269,000 |

| Ohio | Ohio CollegeAdvantage 529 Savings Plan | Qualified distributions from any 529 plans are exempt. Distributions are also exempt in the case of beneficiary’s death, disability or receipt of a scholarship. | Ohio taxpayers can deduct up to $4,000 per beneficiary per year from their Ohio income taxes with unlimited carryforward. | $462,000 |

| Oklahoma | Oklahoma College Savings Plan | Qualified distributions from any 529 plans are exempt. | Oklahoma taxpayers can deduct up to $10,000 for single filers/$20,000 for joint filers per year. Excess contributions can carry over for the following five years. | $300,000 |

| Oregon | Oregon College Savings Plan | Qualified distributions from any 529 plans are exempt. | Oregon taxpayers can deduct up to $2,435 for single filers/$4,865 for joint filers for contributions. Amounts are adjusted annually. | $310,000 |

| Pennsylvania | PA 529 | Qualified distributions from any 529 plans are exempt. These plans are also exempt from Pennsylvania inheritance tax. | Pennsylvania taxpayers can deduct up to $15,000 per beneficiary per year ($30,000 for joint filers) for contributions to any 529 plan. | $511,758 |

| Rhode Island | CollegeBound 529 | Qualified distributions from any 529 plans are exempt. | Rhode Island taxpayers can deduct up to $500 for individuals/$1,000 for joint filers. | $395,000 |

| South Carolina | Future Scholar 529 College Savings Plan | Qualified distributions from any 529 plans are exempt. | South Carolina taxpayers can deduct up to 100 percent of contributions made to their state’s 529. | $500,000 |

| South Dakota | College Access 529 | No personal income tax. | No additional benefits. | $350,000 |

| Tennessee | TN Stars 529 Savings Plan | No personal income tax. | No additional benefits. | $350,000 |

| Texas | Texas College Savings Plan | No personal income tax. | No additional benefits. | $370,000 |

| Utah | My529 | Qualified distributions from any 529 plans are exempt. | Utah taxpayers can claim tax credits for accounts which they own. Click here for more details on Utah’s credits. | $485,000 |

| Vermont | Vermont Higher Education Investment Plan | Qualified distributions from any 529 plans are exempt. | Vermont taxpayers can get a state income tax credit of 10 percent of the first $2,500 contributed to the account per beneficiary per year (the first $5,000 for married filing jointly). | $352,800 |

| Virginia | Virginia 529 | Qualified distributions from any 529 plans are exempt. Virginia also exempts distributions from in-state plans due to beneficiary’s death, disability or scholarship receipt. | Virginia taxpayers can deduct up to $4,000 per beneficiary per year from their individual income taxes ($8,000 for joint filers) | $500,000 |

| Washington | DreamAhead College Investment Plan | No personal income tax. | No personal income tax. | $500,000 |

| West Virginia | SMART529 West Virginia | Qualified distributions from any 529 plans are exempt. | No additional benefits. | $400,000 |

| Wisconsin | EdVest | Qualified distributions from any 529 plans are exempt. | Wisconsin taxpayers can deduct up to $3,280 in contributions per beneficiary per year ($1,640 for married filing separately and divorced parents). Excess contributions may be carried forward. | $488,000 |

| Wyoming | No plan available. |

*Note: This table does not include prepaid 529 plans, which work differently from regular 529s. You can find out more about these plans here.

Other Points to Consider

Besides figuring out your state’s tax benefits or lack thereof for 529s, you’ll also want to consider some of the following points:

Plan Costs and Investment Options

Remember, you don’t have to use your state’s 529 plan just because it exists. Different plans have different costs and investment options. It’s okay, and usually a good idea, to shop around so you know what’s available. Sometimes a high-fee plan with poor investment choices isn’t worth the state tax benefits, especially since most states exempt qualified distributions even from out-of-state plans.

Long-Term Savings Benefits

Consider carefully the costs of dipping into your 529 plan before college. The majority of the plans’ income tax benefits are geared toward account growth. Reducing the balance of the account means you compound less interest, which could hurt your education savings bottom line in the long run.

Financial Aid Impacts

Before taking distributions from a 529 plan for either K–12 or college expenses, be sure you understand how those distributions or the account’s balance might affect future financial aid based on the FAFSA. Federal aid calculations are complicated, to say the least, so talk to a college financial planning expert about these decisions.

Gift Tax Limitations

One good thing about 529 accounts is that they don’t have contribution limits, other than the per-beneficiary overall balance limits. However, your contributions to these accounts—whether they’re for your children, grandchildren or someone else—could trigger federal gift taxes, which can be hefty.

For 2019, each individual can gift each other individual up to $15,000 without triggering gift taxes. So you and your spouse could each gift your child $15,000, for a total of $30,000 in 2019, without triggering gift taxes. There are some ways to frontload an account, though, and to spread the tax consequences out over several years. If you have a large chunk of money to contribute to a child’s 529, be sure to talk with your tax professional about the best strategy.

Also, keep in mind each state’s total balance limit. If the limit is $350,000, for instance, you can keep contributing to the account until it reaches that limit—contributions and interest included. After that, the account can continue to grow, but you can’t add any more money to it unless the state increases its account limit.

What It Could Mean for You

So what should you do with the changes in the 529 plan? H&R Block’s Glenn Brown has some advice:

“This is a great idea for families that have already financially planned private K–12 for their children into their family budget plan. It may not be beneficial for those who would empty out their college funds for their children on private tuition before college, with the staggering college tuition loan crisis. Basically, make sure it makes sense for your family. Maybe private high school and college end up being your priorities, for example, and you can supplement K–8th education if needed.

Of course, you should talk with a tax professional familiar with the latest 529 developments in your state about any decisions like these.

This 529 expansion offers some additional educational freedom to those Americans who can afford to set aside personal dollars for their children’s educational needs. But ultimately, middle- and low-income families benefit more from stronger school choice programs like education savings accounts (ESAs) and vouchers.

To find out if your state has one of these educational choice programs, or a tax-credit scholarship or individual tax credit or deduction, visit our School Choice in America Dashboard. There, you’ll find up-to-date information on every private school choice program in America.