Educational Freedom and Choice Hits Escape Velocity: End-of-Session Wrap-Up

Editor’s note: This article was originally published July 19, 2023. It was updated in December to reflect legislative activity in North Carolina, Pennsylvania, and New Hampshire.

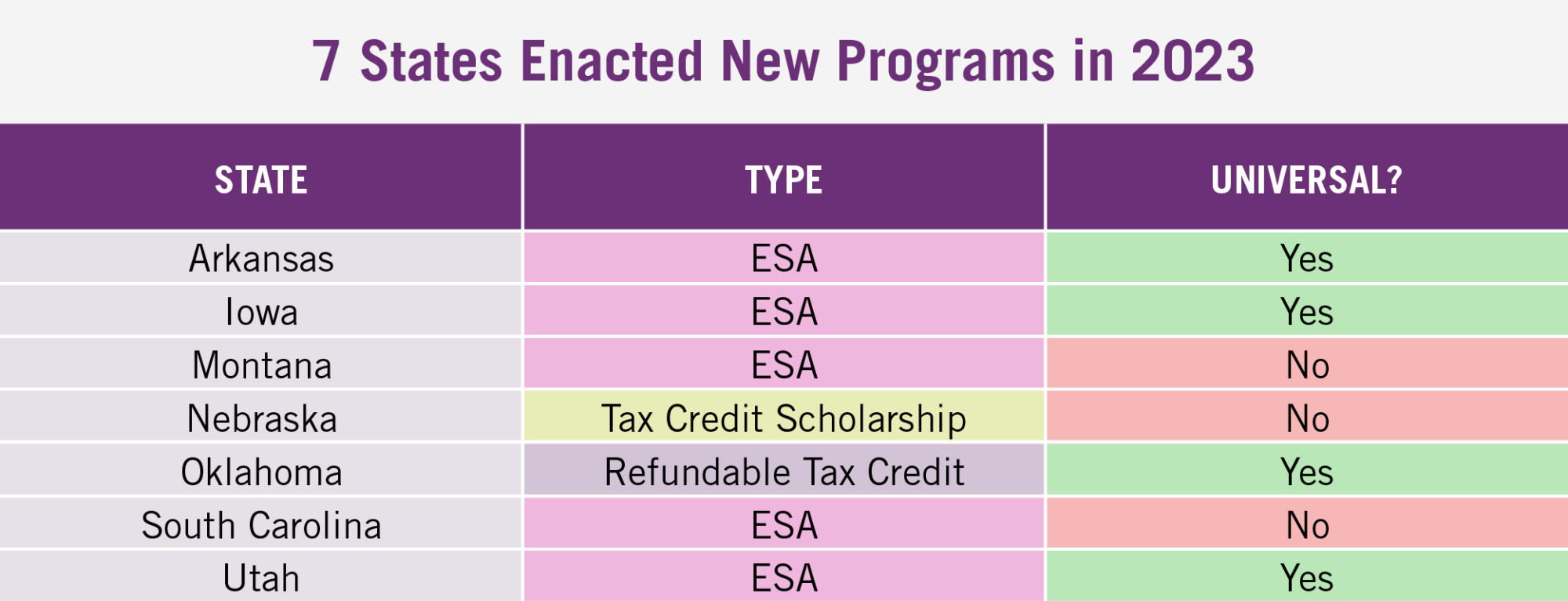

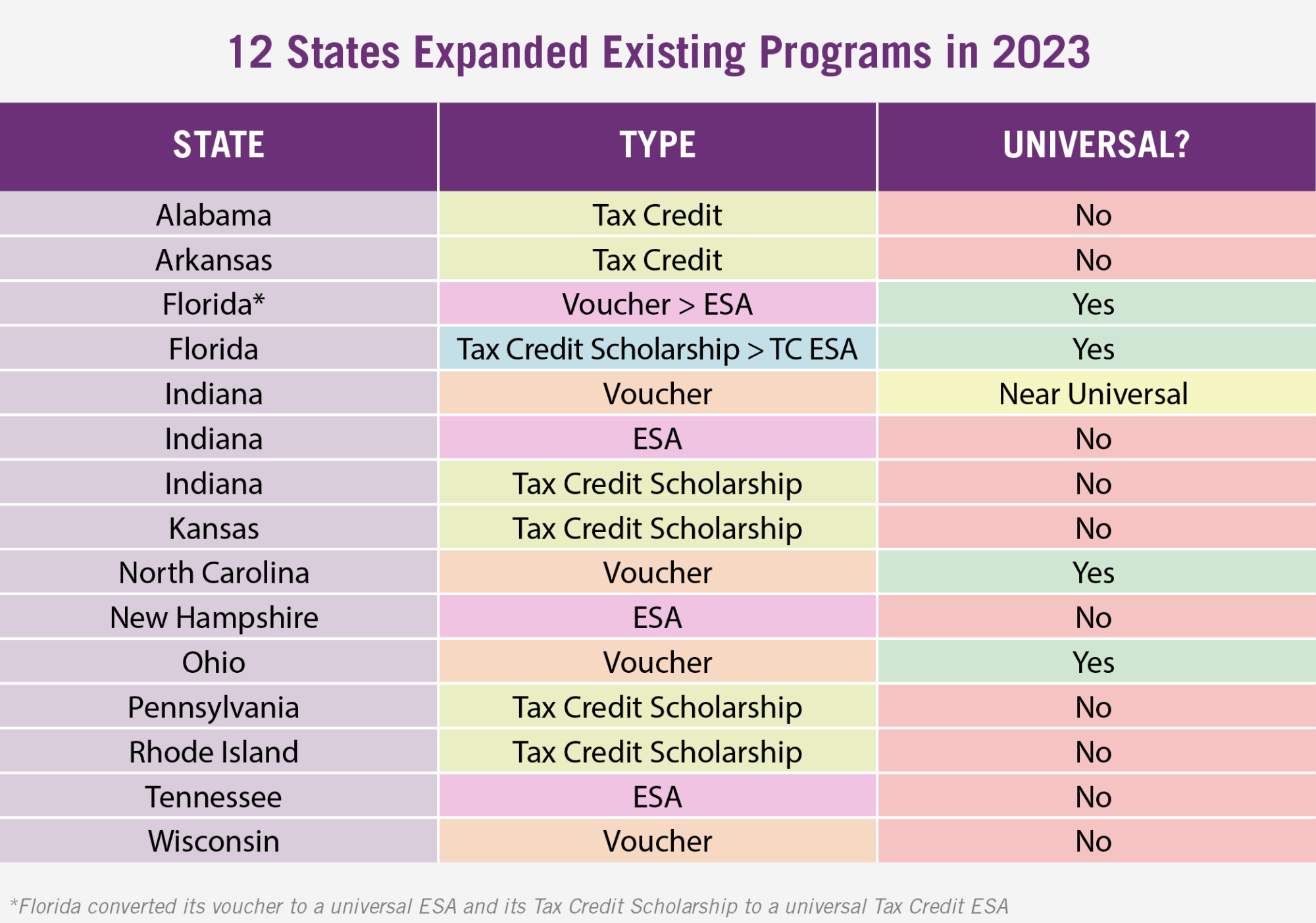

If there ever was a watershed moment, or a watershed year, in educational choice, this is it. Seven states enacted new private choice programs. Twelve states expanded existing private choice programs. Of the states that created new programs or expanded existing ones, eight will be available to all or nearly all students in the states, making 2023 the Year of Universal Choice.

This year, there were 111 bills introduced in 40 states relating to Education Savings Accounts (ESAs), Vouchers, Tax-Credit Scholarships, and Refundable Tax Credits. Seventy-nine percent of those bills were related to ESAs.

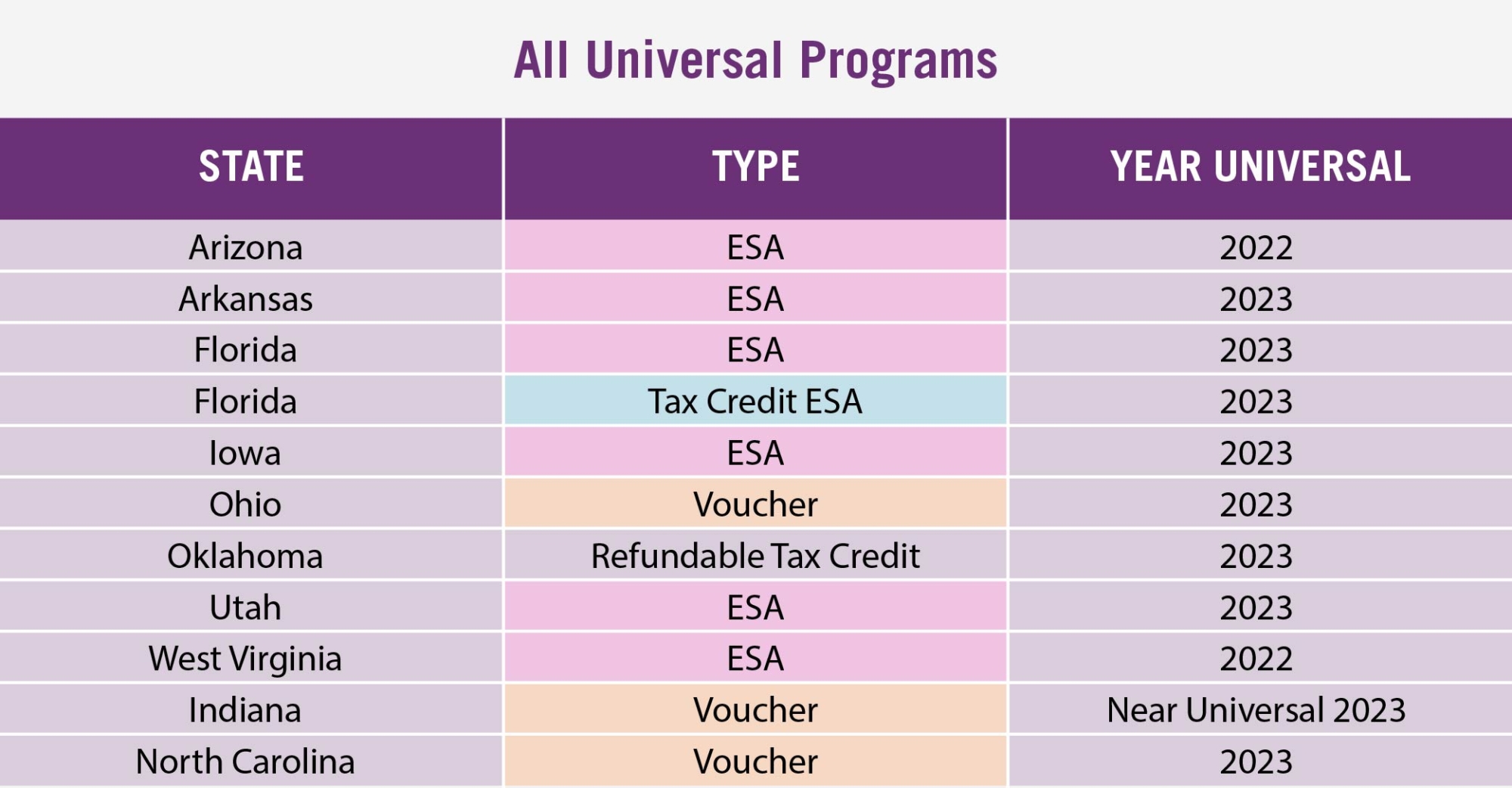

But mere vote counting doesn’t do 2023 justice. Seven new states went universal with their programs—eight if you count Indiana’s now near universal voucher. As it stands, nine states now have universal programs: Arizona, Arkansas, Florida, Iowa, North Carolina, Ohio, Oklahoma, Utah, West Virginia. The universal discussion must also include Indiana, with some 98% of students meeting the state’s income threshold.

In terms of access for American K-12 students, the growth is astounding. One-in-five students now lives in a state with universal (or near-universal) choice. After the most recent expansions, approximately 20 million students—or 36%—nationwide are eligible for a private choice program. This is a 60% increase in access to private choice since just two years ago.

And participation (take-up) is going viral as well. The number of students actually using education savings accounts has nearly tripled, jumping from 33,000 in 2022 to 93,000 in 2023. Next year appears poised for a similarly exponential jump, based on reports out of Iowa and Florida, where applications have been flying in by the thousands.

It has truly been the Year of Universal Choice.

Here’s our end of session wrap-up, detailing which states expanded educational freedom and choice in 2023:

New Hampshire

NH Gov. Sununu signed HB 367 into law in June, expanding the eligibility of the state’s Education Freedom Account (EFA) program to include students from families earning up to 350 percent of the federal poverty line (up from 300 percent). Now, any student from a family of four making up to approximately $105,000 annually may participate. The EFA program is an education savings account program offering participating families about $4,700 a year for qualifying educational expenses.

Ohio

In June, Ohio’s Senate passed a version of the budget incorporating SB 11, expanding eligibility for the Educational Choice Scholarship (voucher) program to universal eligibility. It was signed into law by Gov. DeWine on July 4, 2023. Participating K-8 students are eligible for up to a $5,500 voucher, and participating high school students are eligible for up to a $7,500 voucher.

Wisconsin

In June, Wisconsin Speaker of the House Robin Vos, and Governor Tony Evers, agreed to increase funding for the Parental Choice (Voucher) Program through the state budget, SB 330. Under the new structure, scholarships for K-8 students will increase to $9,499, and K-12 vouchers will expand up to $12,000 per student. Wisconsin’s voucher program will now offer families a 73% of public school per-student spending.

Kansas

In May, state budget bill SB 113 passed the legislature, and Gov. Laura Kelly signed it into law. This will expand the Tax Credit for Low-Income Students Scholarship Program student eligibility from 185% of Federal Poverty to 250% of Federal Poverty. The passed budget also increases the credit value donors receive for funding a student’s education from 70% to 75%.

South Carolina

SB 39 creates the South Carolina Education Scholarship Trust Fund Program, a $6,000 ESA for about 71 percent of South Carolina families. It was signed into law by Gov. Henry McMaster in May.

Montana

HB 393, legislation creating an ESA for students with disabilities, was signed into law in May by Gov. Greg Gianforte. The Montana Special Needs Equal Opportunity Education Savings Account Program will offer some 12% of Montana students accounts initially worth $6,000 for elementary student and $8,000 for high schoolers.

Nebraska

LB 753 passed the legislature in May and was signed into law by Gov. Jim Pillen. This creates the Opportunity Scholarships Act, a tax-credit scholarship program, and Nebraska’s first private choice program! Eligibility is the same qualifier for the National School Lunch Program, with priority given based on five needs-based tiers. Taxpayers could get a credit for the full amount donated or 50 percent of their income tax liability for that year. Scholarship recipients will receive a $5,000 scholarship.

Oklahoma

HB 1934 and HB 2775 are a package deal, creating a universal refundable tax credit for educational expenses. HB 1934 contains the portion regarding the refundable tax credit, and HB 2775 contains funding for public schools along with teacher pay raises. Both bills were signed into law by Gov. Kevin Stitt in May. The Oklahoma Parental Choice Tax Credit provides parents of students in private school a refundable tax credit ranging from a minimum of $5,000 up to a maximum of $7,500 per child to cover the cost of private school tuition and fees, or parents of students in home school a refundable tax credit of $1,000 to cover the cost of unbundled educational expenses.

What makes the credit “refundable,” is if the credit exceeds the tax imposed by the government, the excess amount is refunded to the taxpayer (the parents)—similar to the Child Tax Credit, or Earned Income Tax Credit. In other words, if the cost of tuition or other allowable educational expenses exceeds what the parent owes the state in taxes, the parent can still receive up to the maximum allowable credit to offset those expenses.

Indiana

State budget bill HB 1001 passed the legislature, and Gov. Holcomb’s signed it into law. This will expand the Indiana Choice Scholarship Program’s student eligibility to near-universal! The passed budget raises the income threshold from 300 percent to 400 percent of the federal free and reduced-price lunch program income limits and eliminates the other pathways for eligibility, such as being a foster care student, being a student with special needs and being assigned to an “F”-graded public school. With this measure, student eligibility increases from 77 percent to 98 percent. Students receive an average voucher amount of $5,439.

Arkansas

In March, state legislators passed SB 294 (The Learns Act), which Gov. Sanders signed into law. This sweeping reform creates the Arkansas Children’s Educational Freedom Account Program—an education savings account (ESA). It would make all (presently almost a half million) students eligible by 2025. Initial ESAs will be valued at $6,614. This bill also increases teacher pay and raises the Philanthropic Investment in the Arkansas Kids Scholarship Program’s total tax credit cap, taking it from $2 million to $6 million with a 5 percent automatic escalator.

Florida

March went out like a lion as Gov. DeSantis signed the Family Empowerment Scholarship Program’s expansion and conversion into law. SB 202/HB 1 expanded Florida’s targeted voucher program into a universally eligible education savings account. The average account value for students is $7,612. With this bold act by the legislature and governor, Florida now offers broadly flexible educational choice to 2.7 million students.

Iowa

Late January, Iowa Gov. Kim Reynolds enacted HF 68, which created the Students First Act—an education savings account program. Eligibility starts at 300 percent of federal poverty level in 2023 then raises to 400 percent in 2024 then goes universal by 2025.

Utah

Gov. Spencer Cox signed SB 215 on January 28, 2023, creating the state’s first universal school choice program. The bill allows all K-12 Utah students to be eligible for an $8,000 education savings account through the Utah Fits All Scholarship Program beginning in the 2024–25 school year. Though the program is universally eligible, the initial budget cap of $42.5 million will allow a maximum of 5,312 students to participate in year one.

North Carolina

Lawmakers in September signed off on a budget for the state, which included an expansion of North Carolina’s Opportunity Scholarships voucher program to universal eligibility. Gov. Roy Cooper allowed the program to be expanded without his signature. Voucher amounts are based on family income, and range from approximately $3,200 to $7,200.

Pennsylvania

HB 301 passed the legislature in December and was signed into law by Gov. Josh Shapiro. This expands the state’s tax credit scholarship programs—Educational Improvement Tax Credit and Opportunity Scholarships Tax Credit—by $150 million

We’ve hit escape velocity. Educational freedom and choice is here to stay. It’s only a matter of time before every dollar follows every child to an educational setting of their parent’s choice.